IR

Financial Information

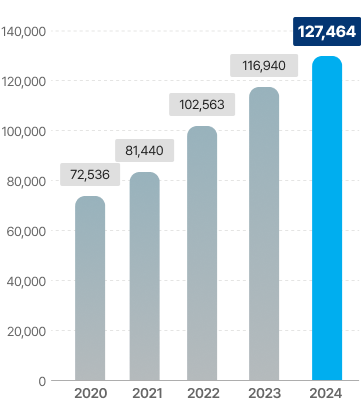

- SalesUnit: Hundred million won

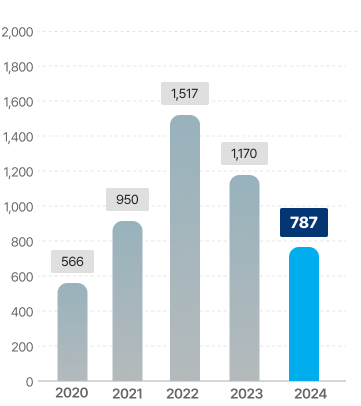

- Operating ProfitUnit: Hundred million won

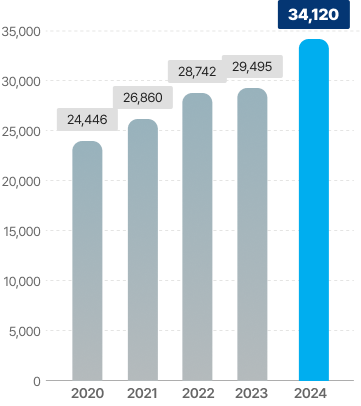

- Total CapitalUnit: Hundred million won

※ The figures above are based on consolidated financial statements.

Consolidated Balance Sheet

Unit: Hundred million won

| Category | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Current Assets | 32,792 | 35,820 | 43,119 | 43,438 | 53,704 |

| Non-current assets | 27,474 | 30,547 | 32,092 | 36,723 | 44,006 |

| Total Assets | 60,266 | 66,367 | 75,211 | 80,161 | 97,710 |

| Current Liabilities | 22,139 | 21,601 | 31,472 | 33,981 | 44,230 |

| Non-current Liabilities | 13,681 | 17,906 | 14,997 | 16,685 | 19,360 |

| Total Liabilities | 35,820 | 39,507 | 46,469 | 50,666 | 63,590 |

| Capital | 4,095 | 4,095 | 4,095 | 4,095 | 4,095 |

| Total Capital | 24,446 | 26,860 | 28,742 | 29,495 | 34,120 |

| Debt Ratio | 147% | 147% | 162% | 172% | 186% |

Consolidated Income Statement

Unit: Hundred million won

| Category | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Sales | 72,536 | 81,440 | 102,563 | 116,940 | 127,464 |

| Gross Profit | 3,330 | 3,987 | 5,836 | 5,728 | 6,346 |

| Sales & Management Expenses | 2,764 | 3,037 | 4,319 | 4,558 | 5,559 |

| Operating Profit | 566 | 950 | 1,517 | 1,170 | 787 |

| Pre-Tax Profit | 96 | 1,043 | 1,226 | 1,280 | 352 |

| Net Income | △52 | 906 | 1,235 | 967 | 231 |

※ K-IFRS consolidated basis

Audit Report

| Year | Content | Download |

|---|---|---|

| 2024 | Audit Report (Consolidated) | 2024 The 26th Fiscal Year Settlement |

| 2024 | Audit Report (Separate) | 2024 The 26th Fiscal Year Settlement |

| 2023 | Audit Report (Consolidated) | 2024 The 26th Fiscal Year Settlement |

| 2023 | Audit Report (Separate) | 2024 The 26th Fiscal Year Settlement |

| 2022 | Audit Report (Consolidated) | 2024 The 26th Fiscal Year Settlement |

| 2022 | Audit Report (Separate) | 2024 The 26th Fiscal Year Settlement |

| 2021 | Audit Report (Consolidated) | 2024 The 26th Fiscal Year Settlement |

| 2021 | Audit Report (Separate) | 2024 The 26th Fiscal Year Settlement |

Investor Information

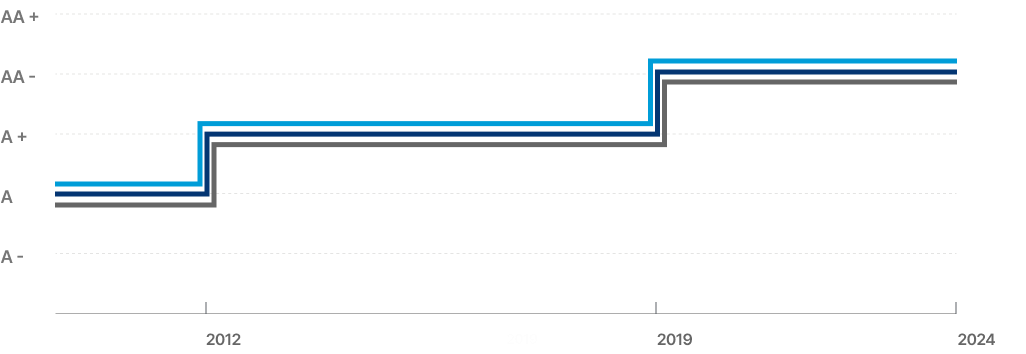

Credit Rating

- Korea RatingsAA-

- Korea InvestorsAA-

- NICE Investors ServiceAA-

Korea Ratings

Korea Ratings Korea Investors

Korea Investors NICE Investors

NICE Investors

Stock Issuance Information

| Types of Stocks | Total Number of Issued Stocks | Capital Stock |

|---|---|---|

| Common Stocks | 81,897,803 Shares | KRW 409,489 million |

| Preferred Stocks | - | - |

| Total | 81,897,803 Shares | KRW 409,489 million |

※ The par value per share is KRW 5,000.

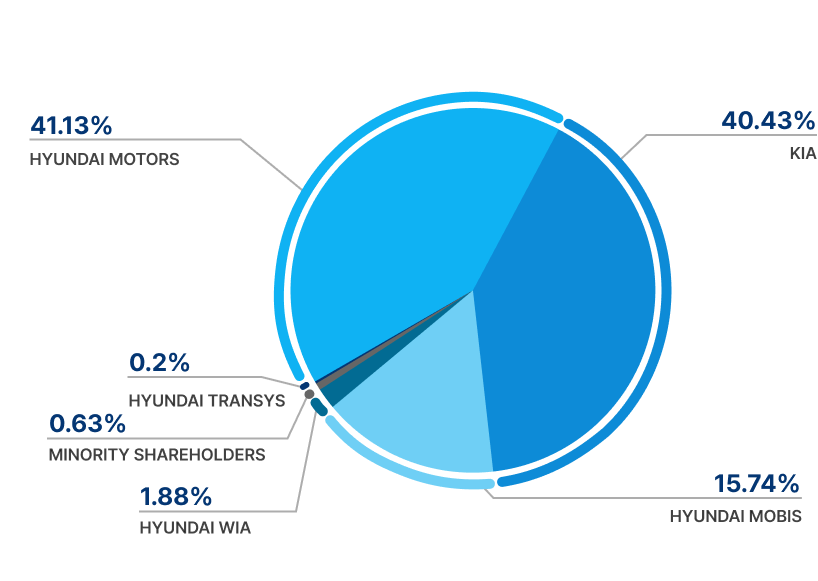

Status of Shareholders

| Category | Shareholders | Number of Shares Owned | Ownership |

|---|---|---|---|

| Affiliates | Hyundai Motor Company | 33,682,754 shares | 41.13% |

| Kia | 33,112,741 shares | 40.43% | |

| Hyundai Mobis | 12,893,176 shares | 15.74% | |

| Hyundai Wia | 1,536,170 shares | 1.88% | |

| Treasury Shares | HYUNDAI TRANSYS | 160,007 shares | 0.20% |

| Other | Minority Shareholders | 512,955 shares | 0.63% |

| Total | 81,897,803 shares | 100% | |

※ Stock issuance details: the par value per share is KRW 5,000

※ All common stocks (no preferred stocks)

Board of Directors

Current Status

- Inside Director(Chairperson)Baek Cheol-seungPresident of HYUNDAI TRANSYS

-

- Initial Appointment Date2024. 12

- Recent Appointment Date2024. 12

- ResponsibilityCEO

- Term2027. 03

- Inside DirectorHong Seok-beomManaging Director, HYUNDAI TRANSYS

-

- Initial Appointment Date2024. 12

- Recent Appointment Date2024. 12

- ResponsibilityHead of Production Division

- Term2027. 03

- Inside DirectorJeong Baek-jungManaging Director, HYUNDAI TRANSYS

-

- Initial Appointment Date2025. 03

- Recent Appointment Date2025. 03

- ResponsibilityHead of Finance and Accounting Division

- Term2028. 03

- Outside DirectorKim Hyoun-jinProfessor, Department of Aerospace Engineering, Seoul National University

-

- Initial Appointment Date2020. 03

- Recent Appointment Date2023. 03

- ResponsibilityManagement Strategy Advisory

- Term 2026. 03

- Outside DirectorChoi Myung-sukKim & Chang lawyer

-

- Initial Appointment Date2022. 03

- Recent Appointment Date2025. 03

- ResponsibilityManagement Strategy Advisory

- Term2028. 03

- AuditorKim Woo-yeolHead of Financial Management Department, Hyundai Motor Company

-

- Initial Appointment Date2024. 03

- Recent Appointment Date2024. 03

- ResponsibilityAuditor

- Term2027. 03

Board of Directors Competency Chart

| Category | Inside Directors | Outside Directors | ||||

|---|---|---|---|---|---|---|

| Baek Cheol-seung | Hong Seok-beom | Jeong Baek-jung | Kim Hyoun-jin | Choi Myung-seok | ||

| Competency Indicators | Leadership 5/5(100%) |

● | ● | ● | ● | ● |

| Accounting/Finance/Management 4/5(80%) |

● | ● | ● | ● | ||

| Industry/Technology 4/5(80%) |

● | ● | ● | ● | ||

| Legal/Policy 3/5(60%) |

● | ● | ● | |||

| Global Competency 5/5(100%) |

● | ● | ● | ● | ● | |

| ESG 5/5(100%) |

● | ● | ● | ● | ● | |

| Diversity Indicators | Year of appointment | 2024 | 2024 | 2025 | 2020 | 2022 |

| Year of birth | 1968 | 1970 | 1971 | 1975 | 1962 | |

| Gender | M | M | M | F | M | |

Articles of Incorporation

- Article 1 (Company Name)

- This company shall be called HYUNDAI TRANSYS INC. <Amended on March 26, 2021>

- Article 2 (Purpose)

- The company is established for the purpose of engaging in the following businesses:

- 1)Manufacturing and domestic/overseas sales of automobile-related parts

- 2)Manufacturing of railway vehicle parts and related equipment

- 3)Manufacturing of military vehicle parts

- 4)Manufacturing of machinery and equipment and sales of related goods

- 5)Import and export business and related agency services

- 6)Service business

- 7)Real estate leasing and sales business

- 8)E-commerce and internet-related business

- 9)Research and development

- 10)All other auxiliary businesses related to the aforementioned matters

- Article 3 (Location of Headquarters)

-

- 1)The company shall have its headquarters in Seosan-si, Chungcheongnam-do, Korea.

- 2)The company may establish branches, offices, business locations, and local corporations domestically and internationally by mediation of the Board of Directors.

- Article 4 (Public Notices)

- The company's public notices shall be posted on the company's website (http://www.hyundai-transys.com).

However, in cases where system failures or other unavoidable circumstances prevent posting on the website, notices shall be published in the Korea Economic Daily newspaper issued in Seoul.

- Article 5 (Total Number of Shares Issuable)

- The total number of shares that the company may issue shall be 200,000,000 shares.

- Article 6 (Par Value of Each Share)

- The par value of each share issued by the company shall be 5,000 KRW.

- Article 7 (Total Number of Shares Issued at the Time of Incorporation)

- The total number of shares issued by the company at the time of incorporation shall be 10,000,000 shares.

- Article 8 (Types of Shares)

- The shares of the company shall consist of common shares and preferred shares. <Amended on March 26, 2021>

- Article 8-2 (Electronic Registration of Rights to be Indicated on Share Certificates and Stock Subscription Warrants)

- Instead of issuing share certificates and stock subscription warrants, the company electronically registers the rights that should be indicated on such certificates in the electronic registration ledger maintained by an electronic registration institution. <Revised March 26, 2021>

- Article 9 (Number and Details of Preferred Shares))

-

- 1)The number of non-voting preferred shares that the company may issue shall be within the limits prescribed by law.

- 2)The preferred shares without voting rights shall receive a preferential dividend of at least 1% per year, based on the par value, with the specific rate determined by the Board of Directors at the time of issuance.

- 3)If the dividend rate of common shares exceeds that of preferred shares, the preferred shares shall participate in the excess dividend at the same rate as the common shares. If the company is unable to pay the prescribed dividend on preferred shares in any fiscal year, the unpaid dividend shall be accumulated and paid preferentially in the following fiscal year.

- Article 10 (Preemptive Rights)

-

- 1)Shareholders of the company shall have the preemptive right to subscribe for new shares in proportion to the number of shares they own.

However, if a shareholder waives or loses their preemptive right, or if odd lots occur during the allocation of new shares, the method of handling such cases shall be determined by a mediation of the Board of Directors. <Amended on March 26, 2021> - 2)Notwithstanding the preceding paragraph, in the following cases, the company may allocate new shares to persons other than existing shareholders by mediation of the Board of Directors for the purpose of introducing new technology, improving the financial structure, or achieving other management objectives. <Amended on March 26, 2021>

- When new shares are issued or are to be subscribed to by an underwriter in accordance with the Financial Investment Services and Capital Markets Act.

- When new shares are issued through a general public offering method in accordance with the Financial Investment Services and Capital Markets Act.

- When new shares are issued due to the exercise of stock options under the provisions of the Commercial Act.

- When new shares are allocated to employee stock ownership association members in accordance with the Financial Investment Services and Capital Markets Act.

- When new shares are issued in accordance with overseas securities issuance regulations, such as the issuance of depositary receipts (DRs).

- When new shares are issued to facilitate foreign capital participation by overseas financial institutions or other foreign investors in accordance with laws related to foreign investment and capital introduction.

- When new shares are issued to joint ventures, technology providers, raw material or component suppliers, or companies engaged in other business partnerships that are necessary for company operations, both domestically and internationally.

- When new shares are issued due to capital participation through debt-to-equity conversion by financial institutions, such as banks.

- When new shares are issued as consideration for contributions in kind.

- When new shares are issued to domestic and international investors for other business management purposes.

- 1)Shareholders of the company shall have the preemptive right to subscribe for new shares in proportion to the number of shares they own.

- Article 10-2 (Equal Dividend)

- The company will distribute dividends equally on the same type of shares issued as of the dividend record date (including those that have been converted), regardless of the issuance date. <Amended on March 26, 2021>

- Article 11 (Agent for Shareholder Registration)

-

- 1)The company shall appoint an agent for shareholder registration.

- 2)The agent for shareholder registration, the location of their office, and the scope of their duties shall be determined by a mediation of the board of directors.

- 3)The company shall keep the shareholder register or a copy of it at the office of the agent for shareholder registration. The agent will handle matters such as the electronic registration of shares, management of the shareholder register, and other share-related tasks. <Amended on March 30, 2020>

- Article 12

- <Deleted on March 26, 2021>

- Article 13 (Record Date)

-

- 1)The shareholders listed in the final shareholder register as of December 31 each year shall be the shareholders entitled to exercise their rights at the regular shareholders' meeting for the fiscal year. <Amended on March 26, 2021>

- 2)In the case of convening an extraordinary shareholders' meeting or other necessary circumstances, the company may, by mediation of the board of directors, set a specific period not exceeding 3 months to suspend changes to the shareholder register or, by mediation of the board, designate a specific date for the shareholder register to determine which shareholders will be entitled to exercise their rights. If the board of directors deems it necessary, the suspension of changes to the shareholder register and the designation of a record date may be done together. The company must announce this at least 2 weeks in advance. <Amended on March 26, 2021>

- Article 14 (Issuance of Bonds)

-

- 1)The company may issue bonds by mediation of the Board of Directors.

- 2)The Board of Directors may delegate to the Representative Director the authority to determine the amount and type of bonds to be issued, provided that the issuance period does not exceed 1 year.

- Article 14-2 (Convertible Bonds)

-

- 1)The company may issue bonds with warrants to persons other than shareholders within the limit of 50% of the total face value of the bonds relative to the company's capital in the following cases:

- When issuing bonds with warrants through public offering.

- When issuing bonds for foreign investment under the Foreign Investment Promotion Act due to management needs.

- When issuing bonds to a partner company for the purpose of technology introduction or business partnership, etc.

- When issuing bonds with warrants to domestic or foreign financial institutions to raise urgent funds.

- When issuing bonds overseas in accordance with Article 165-6 of the Financial Investment Services and Capital Markets and Act (Special Cases concerning Issuance and Allocation of Stocks).

- When issuing bonds with warrants for other management needs.

- 2)The Board of Directors may issue bonds under conditions that grant the right to exercise only a portion of the warrants.

- 3)Shares issued through the exercise of warrants may be either common shares or preferred shares, and the issuance price shall be determined by the Board of Directors at the time of bond issuance, at or above the face value of the shares.

- 4)The period for exercising warrants shall be from the issuance date of the relevant bonds until the day immediately preceding the redemption date. However, the Board of Directors may adjust the exercise period by mediation within this timeframe.

- 5)<Deleted on March 26, 2021>

- 1)The company may issue bonds with warrants to persons other than shareholders within the limit of 50% of the total face value of the bonds relative to the company's capital in the following cases:

- Article 14-4 (Electronic Registration of Rights on Bonds and Warrants)

- The company may electronically register the rights that should be recorded on bond certificates and warrant certificates in the electronic registration account book of an electronic registration institution instead of issuing physical certificates. <Amended on March 30, 2020>

- Article 15 (Convening of General Meetings)

-

- 1)The regular general meeting of shareholders shall be convened within 3 months from the reference date specified in Article 13, Paragraph 1, and an extraordinary general meeting of shareholders shall be convened as necessary. <Amended on March 26, 2021>

- 2)No mediations shall be made at the general meeting of shareholders on matters other than those notified to shareholders in advance. However, this restriction does not apply if all shareholders consent.

- 3)The general meeting of shareholders may be held at the head office, a domestic business location, or an adjacent area.

- 4)Unless otherwise provided by law, the general meeting of shareholders shall be convened by the representative director or a director delegated by the representative director.

- Article 16 (Notice of Convening)

- When convening a general meeting of shareholders, the date, place, and purpose of the meeting shall be notified to each shareholder in writing or electronically at least 2 weeks before the meeting.

- Article 17 (Chairperson)

- The chairperson of the general meeting shall be the representative director. If the representative director is unable to perform their duties, a director designated by the representative director shall act as the chairperson. If no designation is made, one of the directors shall assume the role.

- Article 18 (Exercise of Voting Rights by Proxy)

- A shareholder may exercise their voting rights through a proxy. In such cases, the proxy must submit a document proving their authority before the commencement of the general meeting of shareholders.

- Article 19 (Quorum and Voting Method)

-

- 1)Mediations at the general meeting of shareholders shall be passed by a majority of the voting rights of shareholders present and at least 1/4 of the total issued shares, unless otherwise provided by law or the articles of incorporation.

- 2)Each share shall carry one voting right.

- Article 20 (Maintenance of Order at the General Meeting)

- The chairperson of the general meeting of shareholders may order a person who deliberately disrupts the proceedings or disturbs order to cease speaking, withdraw statements, or leave the meeting. If deemed necessary for the smooth progress of the meeting, the chairperson may also limit the speaking time and frequency of shareholders.

- Article 21 (Minutes of the General Meeting of Shareholders)

- The proceedings and outcomes of the general meeting of shareholders shall be recorded in the minutes, which shall be signed or sealed by the chairperson and attending directors and kept at the head office and branch offices. <Amended on March 26, 2021>

- Article 22 (Appointment of Directors and Auditors)

-

- 1)The company's directors and auditors shall be appointed at the general meeting of shareholders.

- 2)The company's directors and auditors shall be appointed by a majority of the voting rights of the shareholders present and at least 1/4 of the total issued shares. However, in the case of appointing an auditor, a shareholder holding shares exceeding 3% of the total issued shares, excluding non-voting shares, shall not exercise voting rights for the excess shares.

- 3)When appointing 2 or more directors, each shareholder may exercise only 1 voting right per share owned, and Article 382-2 of the Commercial Act (Cumulative Voting) shall not apply.

- Article 23 (Number of Directors and Auditors)

-

- 1)The board of directors of the company shall consist of at least 3 directors, and at least 1 of them may be an outside director.

- 2)The company shall have at least 1 auditor.

- Article 24 (Term of Directors and Auditors)

-

- 1)The term of a director shall be determined by a mediation of the general meeting of shareholders within 3 years. However, if the term expires before the regular general meeting of shareholders for the final settlement period, it shall be extended until the conclusion of that general meeting.

- 2)The term of an auditor shall last until the conclusion of the regular general meeting of shareholders related to the final settlement period within 3 years of appointment.

- Article 25 (Dismissal and Vacancy of Directors and Auditors)

-

- 1)The dismissal of directors and auditors shall be in accordance with Article 385 (Removal) and Article 415 (Provisions Applicable Mutatis Mutandis) of the Commercial Act.

- 2)A director or auditor shall automatically lose his/her position in any of the following cases:

- Submission of a resignation letter to the company

- Declaration of bankruptcy

- Declaration of incompetence or limited competence

- Death

- Article 26 (Filling Vacancies for Directors and Auditors)

-

- 1)If a vacancy arises for a director or auditor, a general meeting of shareholders shall be convened to appoint a replacement. However, if the vacancy does not result in falling below the minimum number required by the Commercial Act and does not hinder business operations, the election of a replacement may be postponed or deferred until the next regular general meeting of shareholders.

- 2)<Amended on March 26, 2021>

- Article 27 (Duties of Directors)

-

- 1)Directors, as members of the board of directors, participate in decision-making related to company operations and have the authority to oversee the execution of executive duties through the board of directors.

- 2)If a director discovers any fact that may significantly harm the company, he/she must immediately report it to the auditor.

- 3)Directors shall faithfully perform their duties in accordance with laws and the company’s articles of incorporation.

- Article 27-2 (Limitation of Liability for Directors and Auditors to the Company)

-

- 1)The company may, by mediation of the general meeting of shareholders, exempt a director or auditor from liability under Article 399 (Liability to the Company) of the Commercial Act for any amount exceeding 6 times (3 times for outside directors) their total remuneration, including bonuses, received in the past year before the act in question. <Amended on March 26, 2021>

- 2)The provisions of paragraph 1 shall not apply if the director or auditor caused damage through willful misconduct or gross negligence, or if the director violated Article 397 (Non-Competition), Article 397-2 (Prohibition of Appropriation of Company's Opportunities and Assets), or Article 398 (Transactions between Directors, etc. and Company) of the Commercial Act.

- Article 28 (Duties of Auditors)

-

- 1)Auditors shall audit the execution of duties by directors.

- 2)Auditors shall audit the company’s accounts and business operations, prepare an audit report on the financial statements, and report to the general meeting of shareholders.

- 3)Auditors may inspect or copy accounting records and related documents at any time and may request business reports from directors or investigate the company’s business and financial status.

- 4)Auditors may attend board meetings and state their opinions.

- 5)If an auditor determines that a director has violated the law or the company’s articles of incorporation, or is likely to do so, he/she must report this to the board of directors.

- 6)Auditors shall review agenda items and documents submitted by directors to the general meeting of shareholders and provide opinions to the shareholders regarding any legal violations or significantly unfair matters.

- 7)If necessary for performing their duties, auditors may request business reports from subsidiaries. If the subsidiary fails to provide a timely report or if verification of the report is necessary, the auditor may investigate the subsidiary’s business and financial status.

- Article 29 (Remuneration of Directors)

-

- 1)The remuneration or necessary business expenses of directors shall be determined by the board of directors within the payment limit set by mediation of the general meeting of shareholders.

- 2)The retirement benefits of directors shall be governed by separately established executive personnel and compensation regulations.

- Article 29-2 (Remuneration of Auditors)

- The remuneration and retirement benefits of auditors shall be governed by the provisions on directors’ remuneration stipulated in Article 29 of these articles of incorporation.

- Article 30 (Liability of Directors and Auditors)

-

- 1)Directors and auditors shall be liable to the company and third parties in accordance with the Commercial Act and other relevant laws in cases of negligence in duty.

- 2)The company shall compensate directors and auditors for all litigation costs, losses, damages, and liabilities incurred or paid in connection with the performance of their duties as directors or auditors. However, this shall not apply if such losses, damages, or liabilities arise from intentional misconduct or gross negligence by the director or auditor, or if such compensation by the company s not legally permitted. <Amended on March 26, 2021>

- Article 31 (Qualifications of Outside Directors)

- Outside directors shall be selected from individuals who have specialized knowledge or experience in business management, economy, law, or relevant technical fields, or who have a distinguished social reputation.

- Article 32 (Composition and Authority of the Board of Directors)

-

- 1)The board of directors shall be composed of directors and shall resolve matters prescribed by laws and these articles of incorporation, as well as important matters related to the company's business operations. It shall also supervise the execution of duties by directors and executives.

- 2)Separate board regulations may be established to define the delegation of authority and other necessary matters concerning the operation of the board of directors.

- Article 33 (Convocation and Mediation Methods of the Board of Directors)

-

- 1)The board of directors shall be convened by the chairperson or a director designated by the board. A notice of the meeting must be provided to each director and auditor, either in writing or verbally, at least 7 days prior to the meeting. However, the convening procedure may be waived if all directors and auditors give their consent. <Amended March 26, 2021> <Amended March 25, 2025>

- 2)Some or all directors may participate in mediations without attending the meeting in person, provided that all directors can simultaneously send and receive voice communications through telecommunication means. In this case, such directors shall be deemed to have attended the meeting in person.

- 3)Mediations of the board of directors shall require the attendance of a majority of directors and the approval of a majority of those present. However, if applicable laws stipulate otherwise, those laws shall prevail. <Amended March 26, 2021>

- 4)<Deleted March 26, 2021>

- Article 34 (Representative Director)

- The board of directors shall appoint the representative director by mediation, and the representative director shall represent the company. <Amended March 26, 2021>

- Article 35 (Agenda Items)

- The chairperson shall propose agenda items for board meetings. However, if any other director wishes to propose an agenda item, he/she must submit a summary of the proposal to the chairperson.

- Article 36 (Minutes of Board Meetings) <Amended March 26, 2021>

-

- 1)Minutes must be prepared regarding the proceedings of the board of directors.

- 2)The minutes shall record the agenda items, the proceedings, the results, the names of dissenting members, and their reasons for dissent. The attending directors and auditors must sign or affix their names and seals to the minutes.

- Article 37 (Executive Management)

-

- 1)The company may appoint executive management to execute mediations of the board of directors.

- 2)Matters related to executive management shall be determined by separate board regulations.

- Article 38 (Advisors, etc.)

-

- 1)The representative director may appoint advisors or consultants as necessary for business purposes.

- 2)The representative director may determine and pay their remuneration or necessary business expenses, similar to the executive management.

- Article 39 (Fiscal Year)

- The fiscal year of the company shall commence on January 1 and end on December 31 of each year.

- Article 40 (Preparation and Retention of Financial Statements)

-

- 1)The representative director of the company shall prepare the following documents, along with their supplementary statements and a business report, at least 6 weeks prior to the date of the regular general meeting of shareholders and obtain the auditor's audit. These documents and the business report must then be submitted to the regular general meeting:

- Balance sheet

- Income statement

- Other documents as required by applicable laws that reflect the company's financial position and business performance <Amended March 26, 2021>

- 2)The auditor shall submit the audit report to the representative director at least 1 week before the regular general meeting.

- 3)Notwithstanding paragraph 1, the board of directors may approve the financial statements by mediation if all of the following conditions are met:

- An external auditor has issued an opinion stating that the documents under paragraph 1 properly reflect the company's financial position and business performance in accordance with applicable laws and regulations.

- Unanimous consent of all auditors is obtained.

- 4)If the board of directors approves the financial statements in accordance with paragraph 3, the representative director shall report the contents of the documents under paragraph 1 to the general meeting of shareholders.

- 5)The representative director shall keep the documents under paragraph 1 and the audit report at the company's headquarters for 5 years and at branch offices for 3 years, starting from 1 week before the regular general meeting.

- 6)The representative director shall promptly announce the balance sheet and the external auditor's audit opinion once the approval of the general meeting of shareholders for each document in paragraph 1 or the approval of the board of directors as per paragraph 3 is obtained.

- 1)The representative director of the company shall prepare the following documents, along with their supplementary statements and a business report, at least 6 weeks prior to the date of the regular general meeting of shareholders and obtain the auditor's audit. These documents and the business report must then be submitted to the regular general meeting:

- Article 41 (Disposition of Profits)

- The company disposes of profits (including retained earnings from previous years) for each business year as follows:

- 1)Earned surplus reserve <Amended March 26, 2021>

- 2)Other statutory reserves

- 3)Dividends

- 4)Voluntary reserves

- 5)Other appropriated retained earnings

- Article 42 (Dividend of Profits)

-

- 1)Profit dividends are paid to the shareholders or registered pledgees listed in the shareholder register as of the end of each business year. However, with a mediation of the board of directors, a certain amount of profit may be distributed as an interim dividend to shareholders on a specific date during the business year, but only once.

- 2)The dividend of profits may be made in cash, stock, or other assets, and in the case of an interim dividend, it will be in cash. <Amended March 26, 2021>

- 3)The right to claim dividends expires if not exercised within 5 years.

- 4)Any dividends that expire due to the completion of the limitation period in paragraph 3 will belong to the company.

- Article 43 (Bylaws)

- The company may establish rules or regulations necessary for its business by mediation of the board of directors.

- Article 44 (Applicable Provisions)

- Matters not stipulated in these Articles of Incorporation shall be governed by the Commercial Act or other laws and regulations.

- These Articles of Incorporation came into force on December 28, 1999.

- Amended from March 25, 2000

- Amended from February 8, 2001

- Amended from December 3, 2002

- Amended from March 15, 2003

- Amended from December 24, 2003

- Amended from March 13, 2004

- Amended from March 09, 2005

- Amended from March 21, 2008

- Amended from March 27, 2009

- Amended from December 27, 2010

- Amended from March 21, 2012

- However, the amendments to Articles 14, 27, 2, 40 and 42 shall take effect on April 15, 2012.

- Amended from March 20, 2015

- Amended from March 25, 2016

- Amended from March 24, 2017

- The revision from the date of registration of the merger between this company and Hyundai Power Tech Co., Ltd. shall take effect on January 2, 2019.

- Amended from March 30, 2020

- Amended from March 26, 2021

- The revision shall take effect on March 25, 2025.